Delivering strong growth, minimized risk and the funding to support all your church's goals.

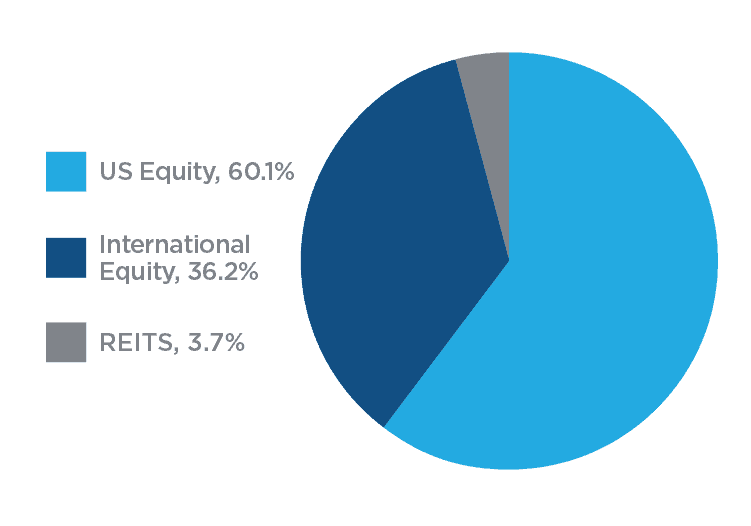

The Equity Portfolio

An equity portfolio involves the greatest risk, but perhaps the greatest gain. Its diversified equities seek long-term growth of capital through a broad range of securities and sector exposures. Consistent global market capitalization, nearly half of the portfolio, is invested in international stocks. This portfolio is subject to a relatively high level of risk because of its 100 percent equity securities.

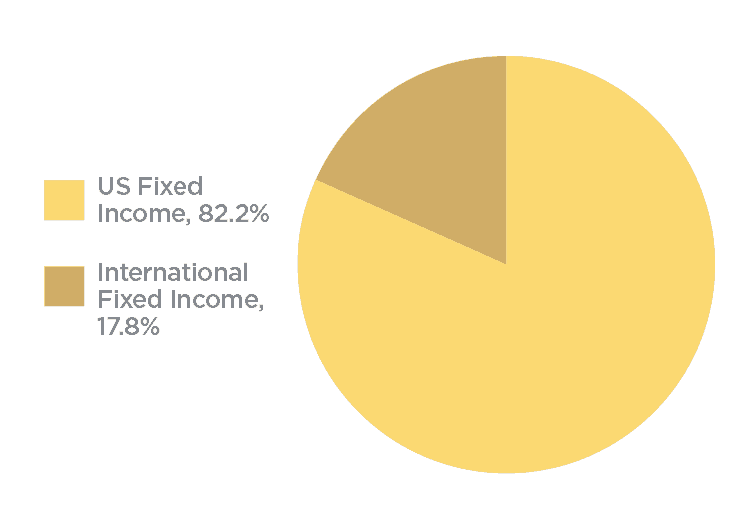

The Fixed-income Portfolio

Fixed-income portfolio seeks to provide income through diversified, high-quality fixed income investments and a small allocation of international fixed income. This portfolio strives to maintain a high level of credit quality through securities issued by the U.S. government, its agencies, foreign governments and high-quality corporate bonds. Historically, the fixed-income portfolio has experienced less volatility than an equity portfolio, but it can experience wide fluctuations in value.

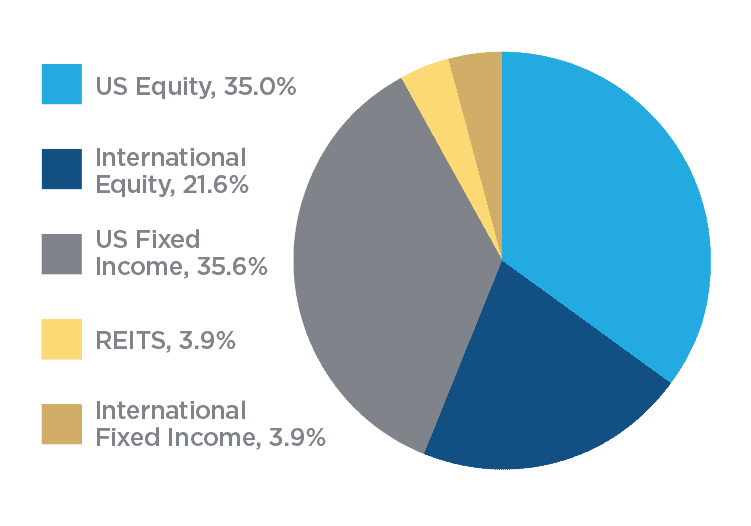

The Balanced Portfolio

Balanced portfolio strives for steady growth through multiple asset classes, each with broad diversification. Approximately 40 percent of assets is invested in high-quality fixed income, and 60 percent is invested in a diversified portfolio of equity securities. With the balanced approach, stock market fluctuations have the greatest impact on performance.

Performance Reporting

- December 2025 Portfolio Return

- September 2025 Portfolio Return

- June 2025 Portfolio Return

- March 2025 Portfolio Return

- December 2024 Portfolio Return

- September 2024 Portfolio Return

- March 2024 Portfolio Return

- December 2023 Portfolio Return

- September 2023 Portfolio Return

- June 2023 Portfolio Return

- March 2023 Portfolio Return

- December 2022 Portfolio Return

- September 2022 Portfolio Return

- June 2022 Portfolio Return

- March 2022 Portfolio Return

- December 2021 Portfolio Return

- September 2021 Portfolio Return

- June 2021 Portfolio Return

- March 2021 Portfolio Return